Stewardship in Planned Giving

LinkedIn Twitter Facebook Download Discover the game-changing role of stewardship in our latest nonprofit resource, “Building Lasting Donor Relationships through Stewardship in Planned Giving.” We unravel the art of transforming transactional interactions into deep, meaningful connections that honor the profound trust donors place in your organization. Find out how personalized communication, exclusive engagements, and consistent […]

Effective Communication Techniques for Planned Giving

LinkedIn Twitter Facebook Download Discover the strategy of turning conversations into commitments in our latest nonprofit resource, “Effective Communication Techniques for Planned Giving.” We unpack the keys to crafting messages that resonate, blending compelling narratives with hard data, and painting a vibrant picture of the long-lasting impact of each donation. Engage with tips on sensitive […]

The Five Types of People That Need a Will

Discover why homeowners, newlyweds, parents, pet owners, and those experiencing life changes urgently need a will. Secure your future now.

Make A Will Month: Top 5 Reasons You Need a Will Today

Here are five compelling reasons why NOW is the best time to create a will:

Competition Among Online Estate Planning Platforms: How Nonprofits and Financial Firms Can Benefit

With the rise of online estate planning platforms like LifeLegacy, Freewill, Trust & Will and others, the landscape of estate planning for the masses has significantly evolved.

Make-A-Will Month Strategy Guide

Make-A-Will Month is a crucial time for nonprofits to enhance their planned giving programs. Occurring annually, this event typically encourages individuals to create or update their wills, and importantly, consider leaving a legacy to causes they deeply care about.

Offer an Online Will Without Breaking The Bank

Digital will platforms like LifeLegacy can enable nonprofits and financial firms to promote charitable giving and enhance and the financial wellbeing of their customers/donors.

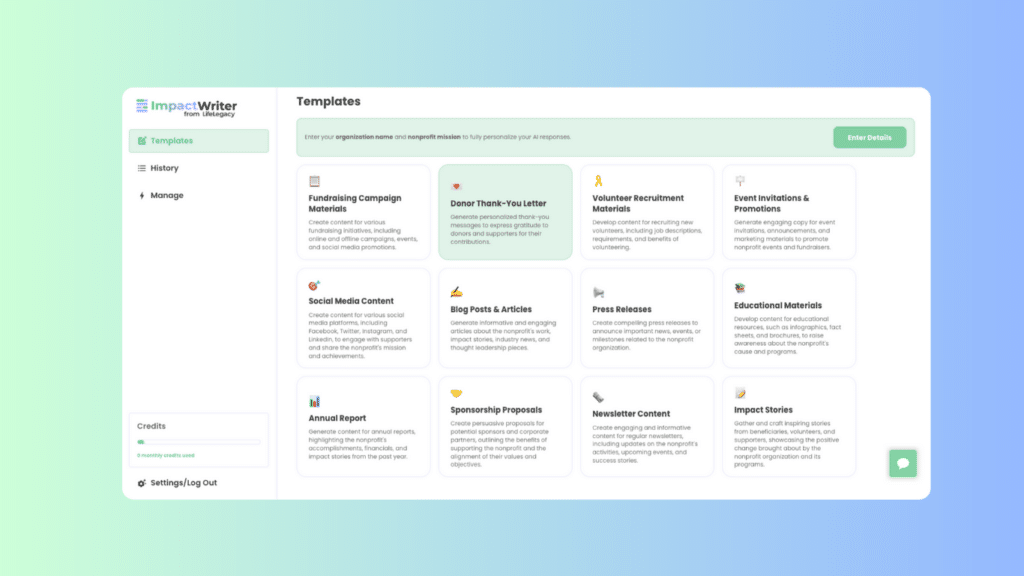

ImpactWriter Webinar

Are you ready to supercharge your fundraising content like never before? We’re thrilled to invite you to LifeLegacy’s live webinar and Q&A for ImpactWriter, the first-ever AI-powered tool designed specifically for fundraising content creation! 🚀

LifeLegacy Teams Up with Perks at Work to Offer Exclusive Estate Planning Perk

LifeLegacy, a leading provider of online estate planning services, has partnered with Perks at Work to offer estate planning to their 30 million members.

End-of-Life Services and Estate Planning – A Great Fit

70% of Americans don’t have an updated will (that’s a lot of people)! And as we near the end of 2023, this marks a good time to set a resolution to get your financial plans in order.