How to Use In-Kind Giving to Advance Donor Stewardship

Learn how nonprofits can use in-kind gifts to deepen donor relationships and strengthen stewardship through thoughtful, memorable, and mission-aligned gestures.

Learn how nonprofits can use in-kind gifts to deepen donor relationships and strengthen stewardship through thoughtful, memorable, and mission-aligned gestures.

The excitement was palpable. We had just started the silent phase of a large comprehensive campaign and I was looking forward to a first gift to jumpstart everything.

Online giving is a vital fundraising channel for nonprofits. Learn how to get better results with these expert tips to improve your online giving strategy.

The most important step in any process is simply starting! How many of us have put off something we need to do around the house for way too long? We need to get our tools and get started! It is the same with planned giving. Don’t wait to start talking about planned giving, just talk about it!

A Qualified Charitable Distribution (QCD) is a powerful tool that allows IRA owners to donate directly to qualified charities, bypassing the usual tax implications of IRA distributions.

Encouraging donors to give from their IRA is a creative way for a donor to give with impact and save on taxes. The impact is the same whether a donor gives from their bank account or their IRA. A QCD gift is a win-win!

AI is becoming increasingly popular in the nonprofit sector. Learn how your organization can get started and use AI to improve its fundraising strategy.

We sat by the river, watching it run the same way the idea we had been talking about was running full steam. His philosophy was “ready, fire, aim!” All of us were just trying to catch up and put a framework around his dreams.

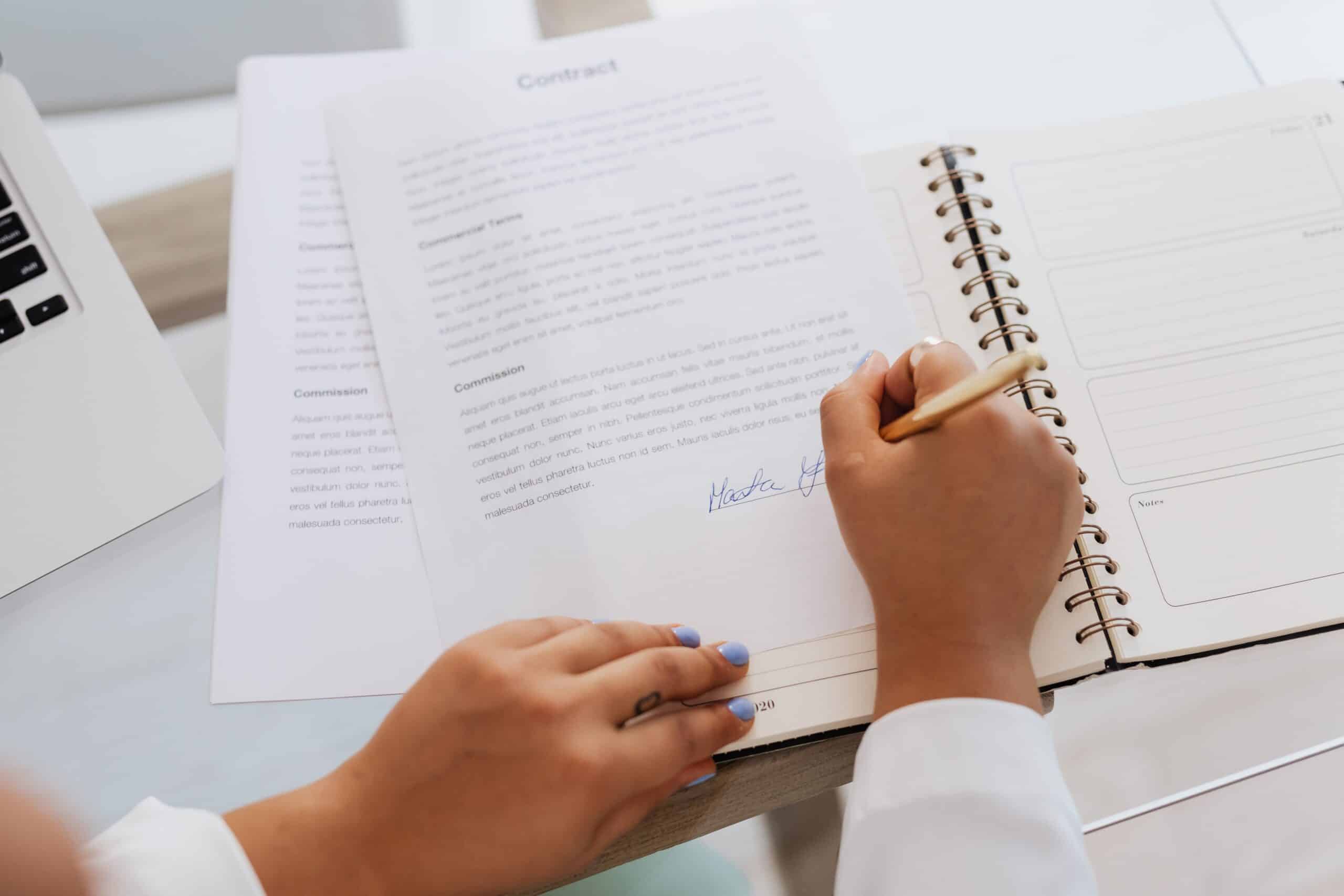

A well-crafted policies and procedures manual is essential for any non-profit. It helps guide how money will be received, how gifts will be entered into your CRM, and what gifts will be accepted and what gifts will not be accepted, among other things.

Every year, if you are over 70.5 years old, you can support a cause you care about AND save on your taxes. If you have an IRA, you can either take a required minimum distribution (RMD) or take a Qualified Charitable Distribution (QCD). The RMD would be taxable, while the QCD is not taxed.

Be the first to get notified when we go live with our will product.